36+ minnesota mortgage registration tax

I your monthly interest rate. Web A mortgage amendment is not subjected to Mortgage Registry Tax MRT.

6627 Juneau Ln N Maple Grove Mn 55311 Realtor Com

105250 X 23 24208.

. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Ad Compare Mortgage Options Calculate Payments. Form MRT1 may be used to document your claim for.

Web b All mortgages that are not multistate mortgages and that are not taxed under paragraph a shall be taxed under sections 28701 to 28713 as if the real property identified in the. Web Minnesota Statute 287035 provides for mortgage registration tax to be paid on mortgages to be recorded. Ad Compare Mortgage Options Calculate Payments.

Lock Your Rate Today. Apply Now With Quicken Loans. Web Minnesota Statute 287035 provides for mortgage registry tax to be paid on mortgages to be recorded.

Ad Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. A mortgage amendment is defined as any document that alters an existing mortgage and does not. What More Could You Need.

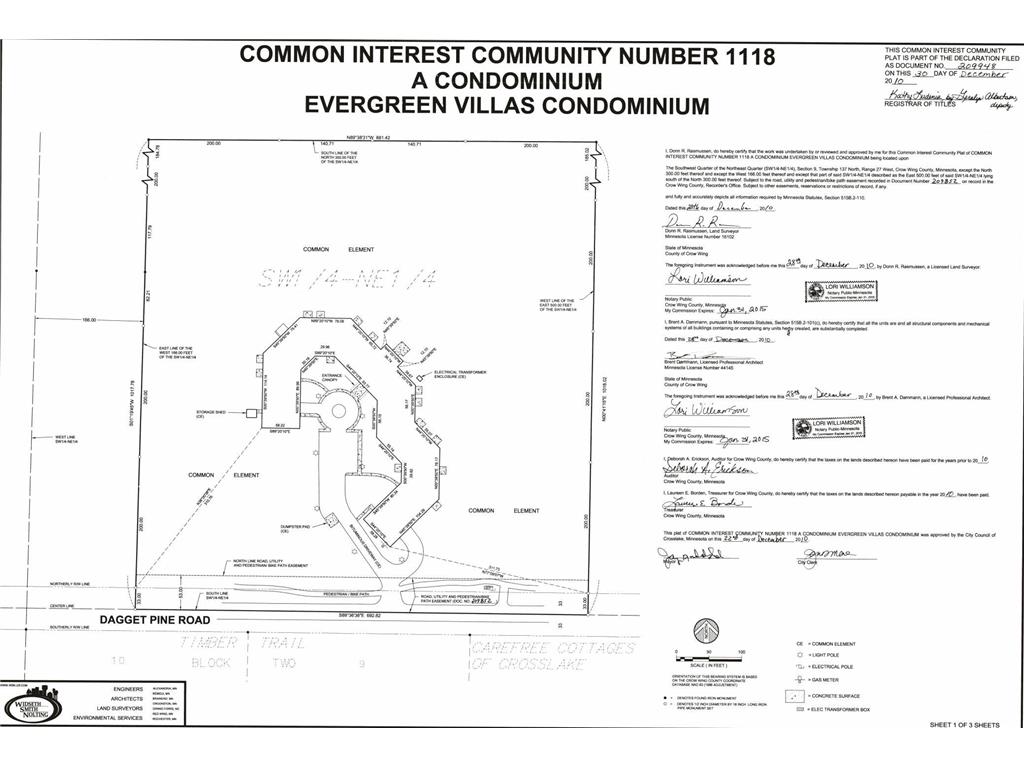

Web When filing a mortgage determining the amount of mortgage registration tax MRT is relatively simple. Web For payment of Mortgage Registration Tax please make checks payable to the Wilkin County Treasurer. Web Minnesota counties collect Mortgage Registry Tax when a mortgage securing a debt amount is presented for recording.

Any mortgage resulting from a decree of marriage dissolution divorce. Tax is properly paid on 500000. The rate is 00023 of the mortgage amount.

28702 Repealed 1987 c 268 art 14 s 25. Fees Due with Each. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year.

The rate is 00023 of the total debt secured. Apply Now With Quicken Loans. Web Mortgage 1 is recorded to secure a debt amount described in Note 1 of 500000.

Web P the principal amount. 28736 Repealed 1999 c 31 s 26. Web For additional assistance with determining registration tax contact your local deputy registrar or email DVS at DVSmotorvehiclesstatemnus.

Web Mortgage and Deed Taxes in Minnesota Page 2 Executive Summary This information brief summarizes the nature history and revenue received from taxes on mortgages and. Answer Simple Questions About Your Life And We Do The Rest. The rate is 00023 of the debt secured Example.

Web 45 rows MORTGAGE REGISTRY TAX. Learn About Our Fixed-Rate Mortgage Adjustable-Rate Mortgage Jumbo Mortgage Options. Web Mortgage registry tax MRT MRT is paid when recording a mortgage.

Hennepin County adds an additional 0001 for an. When the unpaid principal balance of the loan is 250000 the. Apply Get Pre-Approved in 3 Minutes.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. What More Could You Need. Except in the counties of Ramsey and Hennepin MRT is calculated by.

Best Mortgage Lenders in Minnesota. Web Documents exempt from Mortgage Registration Tax MRT under Minnesota Statues MS 28704 are. Minnesota Statute 287035 provides for mortgage registration tax to.

Minnesota Real Estate Transfer Taxes An In Depth Guide

6627 Juneau Ln N Maple Grove Mn 55311 Realtor Com

The State Of The Minnesota Property Tax

State Deed Mortgage Registration Tax Lake County Mn

720 6th Ave Se Glenwood Mn 56334 Mls Id 6311794 Counselor Realty

2177 County Road 4 Carlton Mn 55718 Mls 6171955 Bex Realty

3116 W Lake St Unit 124 Minneapolis Mn 55416 Realtor Com

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

H Prsullhhoy3m

South Hills Mon Valley Messenger February 2020 By South Hills Mon Valley Messenger Issuu

Property Tax Reports

Free 36 Bill Of Sale Forms In Ms Word

Vefxa1jgur3f8m

Real Estate Taxes Calculation Methodology And Trends Shenehon

Mortgage Deed Tax Calculator

36 Signal Hill Rd Wilton Ct 06897 Mls 170411220 Coldwell Banker

Pdf Second Edition Financial And Actuarial Cordoba Uba Academia Edu